First-time homebuyers found it increasingly challenging to fulfill their hopes of achieving the American dream of homeownership as home prices continued to soar, inventory continued to decline, and the market remained competitive. According to the National Association of Realtors, first-time buyers made up 34% of all home buyers, with Millennials representing the majority of them. Many homebuyers, particularly first-time buyers, are delaying their purchases due to the fierce competition, along with the reality that the majority of publications claim that this is the hottest housing market in decades and that sellers are certainly at an advantage.

However, buyers should reconsider their opportunities before giving up and delaying their desire to become homeowners. Even in a competitive housing market, first-time buyers can benefit from low mortgage rates to purchase their first home by taking the proper strategic approach. If you embrace the commitment to become a homeowner with preparedness, it can increase your long-term financial picture and give you a sense of accomplishment. Here’s what you should do if you want to become a homebuyer in this current market.

1. Evaluate your financial situation

It’s important to take your time to organize your finances before you dive into the world of scanning online home listings, going to open houses, and vetting local knowledge. Your financing options will be more clear if you check your credit score; lenders use it to calculate the cost of your loan and whether you can afford to pay back your mortgage. Here’s a fact most first-time buyers don’t realize: The lower your credit score is, the higher the interest rate on your loan will be. The more favorable terms and rates you can obtain for financing, the stronger your credit history will be.

Your debt-to-income (DTI) ratio is a crucial indicator. According to the Consumer Financial Protection Bureau (CFPB), obtaining a qualified mortgage requires a maximum DTI ratio of 43%, which is seen as stable by lenders. If you need to improve your credit, concentrating on debt repayment and maintaining low credit card balances is an excellent place to start.

2. Choose the mortgage type you want to obtain

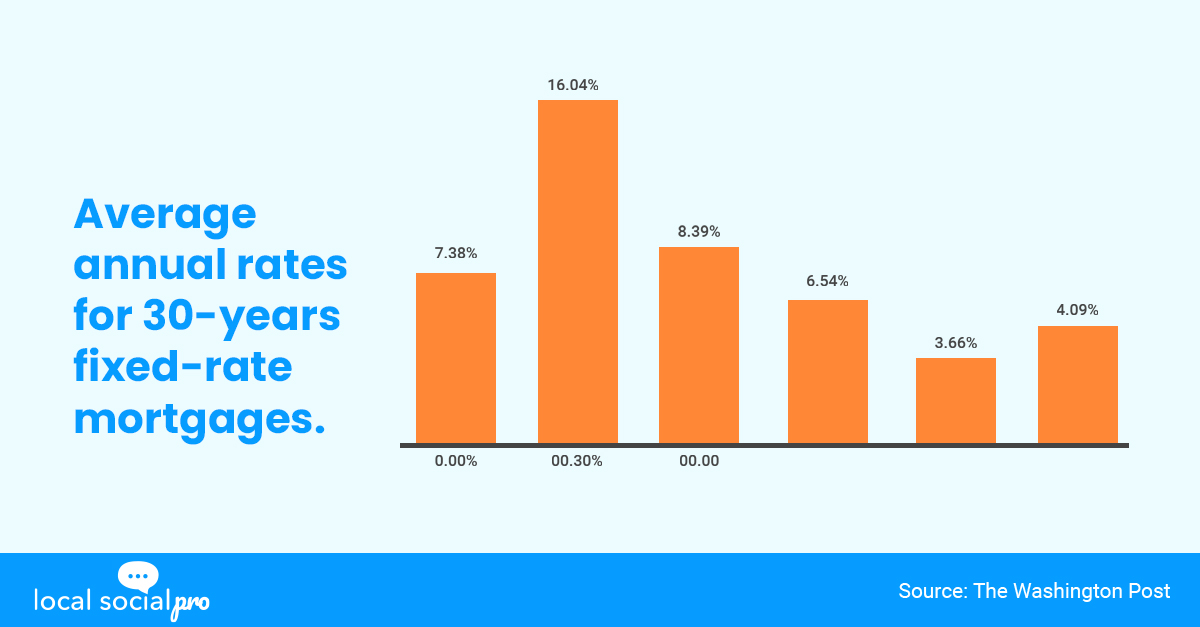

First-time homebuyers usually receive a 30-year, fixed-rate loan. But an ARM can be a great method of saving money if you don’t intend to stay in a house for a long period. For individuals who intend to stay put, fixed-rate loans provide additional safety.

You may want to familiarize yourself with rate fluctuations and the present rate situation when purchasing a property for the first time so that you will know what to anticipate when you get quotes. It is very evident that recent forecasts have shown that affordability decreased year over year due to a combination of rapid nominal house price growth and rising mortgage rates. It pays to shop around and compare mortgage loan rates in the current housing market. Once you’re done with your search, you’re prepared to get preapproved for a mortgage.

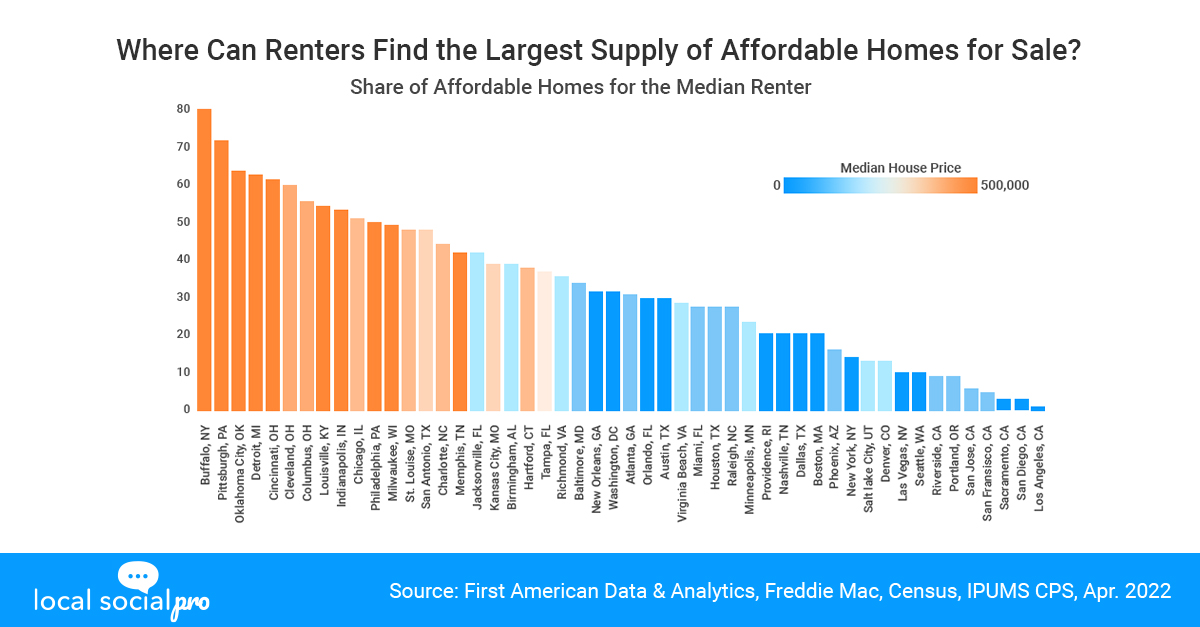

3. Select Your Location

Even while affordability has generally declined, prospective first-time home buyers can choose cities where there are still a lot of reasonable properties available for sale. According to First American Data & Analytics, the median renter must be able to afford at least 50% of the properties for sale for a housing market to be deemed affordable. In 2022, a number of cities did so, some by significant margins. For instance, the 5 cities with the greatest availability of reasonably priced properties to buy were:

-

Buffalo, N.Y. (78%)

-

Pittsburgh (70%)

-

Oklahoma City (62%)

-

Detroit (61%)

-

Cincinnati (60%)

House price rise is likely to slow as the housing market cools because prospective buyers retreat from the market, leaving both supply and demand to normalize. But in the meanwhile, places like Buffalo, New York, Pittsburgh, Oklahoma City, and Detroit give renters or first-time homebuyers the best chances to buy a house.

4. Shop and buy your ideal home

You’ll be in a great position to look for your new house with confidence once you’ve completed all the above-mentioned groundwork. Along with having your finances in order, you’ll also be well-versed in the local market. Be prepared to make an offer quickly if you see a home in your ideal neighborhood and price range and like what you see. Lawrence Yun, chief economist at the National Association of Realtors mentioned that some housing areas may experience slight price reductions if the Federal Reserve raises interest rates even more aggressively than the seven projected increases, but, in his opinion, buyers will still leap in for a “second-chance opportunity” to own a home. When the opportunity arises, it’s best to take that leap and plan your move until you seal the deal.

The Bottom Line:

Being a first–time homebuyer in a seller’s market can be quite frustrating. But you must keep in mind that buying a house is a long-term undertaking and a business decision that demands time to complete. Don’t give in to the pressure of buying a home by moving too quickly, spending too much, or settling for a house you don’t really want. Be as savvy in this market as you would in any other. You should reevaluate your personal asset allocation if you have submitted several bids and are still without a property. There are plenty of alternative methods to wait until you’re ready to actively seek homeownership. Real estate cycles have a tendency to repeat themselves, and no seller’s market has ever persisted permanently. In order to prevent stress before you locate the perfect home, talking to local experts can help you handle your expectations and direct your approach. Keep an eye out for opportunities if you aren’t ready to buy, but if you are, don’t allow the competitive market to deter you. Whether it’s your first or tenth buy, you can be successful with the right standards, amount of preparation, and proper mindset.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!

Follow Hashtags: #Listings #Buyers #Investors #InvestmentProperties #RealtorGaryBredeson #MoveUpBuyers #DownSizingBuyers #FirstTimeBuyers #DivorceSellers #TwinCities #TwinCitiesMN #NationalAssociationOfRealtors

Gary Bredeson

Gary Bredeson