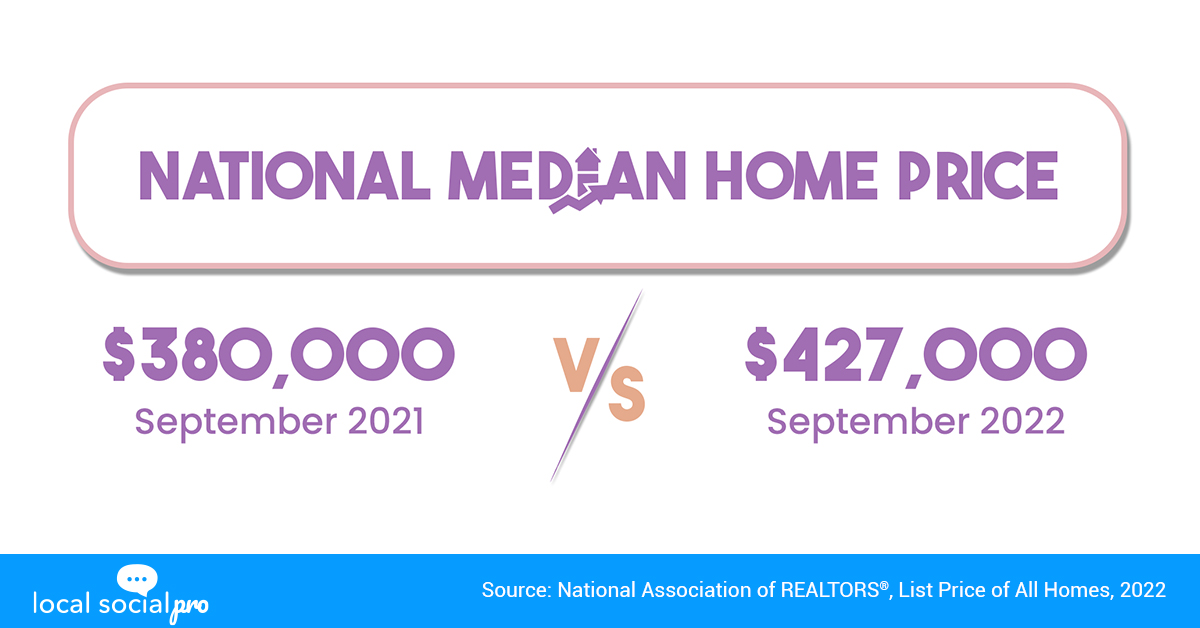

The Pandemic Housing Boom undoubtedly served as an inflationary force. During the crisis, there was simply an excess of demand from homebuyers. As a result, there were intense bidding wars and double-digit price growth in properties. Landlords were able to raise rents because of the rising cost of homes. In addition, homebuilding reached heights not reached since 2006. However, there is growing agreement among experts that the rate of increase in housing prices won’t be as rapid as it has been in recent years. Rising mortgage rates, according to economists, are currently producing a housing slowdown that might reverse the upward trend in home prices or at the very least reduce price growth.

The essential point to keep in mind regarding this market is that supply and demand dictate housing prices. Prices won’t decrease because there is still a significant buyer demand and a lack of available homes. When it comes to growth, they’re slowing down a little bit, but they’ll still be greater than they were at the beginning of this year.

In the months to come, some housing analysts predict large drops in home values, while others predict continued price increases, although at a slower rate. Here are forecasts from experts on the direction of housing values, starting with the most pessimistic predictions.

-

The soaring home prices at the beginning of this year have given way to declining home prices, and Mark Zandi, the chief economist of Moody’s Analytics, anticipates that this trend will continue into the following year. Repeat sales indices, which track national housing prices, predict a peak-to-trough decline of up to 10%, with the bottom expected to come by the end of the following year.

“The problem is affordability. At the current high house prices and high and rising mortgage rates, housing is no longer affordable for potential first-time homebuyers.”

– Mark Zandi, Chief Economist of Moody’s Analytics

All of this is presuming that there won’t be a recession. The peak-to-trough drops in house prices will be closer to 15% if the economy does experience a downturn with a significant rise in unemployment.

-

Home prices will drop, according to Erin Sykes, Chief Economist at real estate agency Nest Seekers, but there will be big variations based on the market. Price drops with double digits may occur in some areas of the country.

“I think it’s tremendously difficult to be a first-time homebuyer right now, and that’s going to be a trend that doesn’t get any better any time soon. Even collecting the downpayment.”

– Erin Sykes, Chief Economist at Real Estate Agency Nest Seekers

Real estate is local; some places may have a 5% decline while others may experience a 30% pullback. It really depends on what the location has to offer beyond the fundamentals. People will encounter extremely diverse realities in different ways.

-

According to Zillow’s Chief Economist Skylar Olsen, property values will increase by 1.2% until August 2023.

“Buyers who remain in the market will have a less stressful experience than they’ve had over the past couple of years, with more time to consider their options and less chance of a bidding war. This is all part of a much-needed rebalancing into a healthier market with a more sustainable pace of growth.”

– Skyler Olsen, Chief Economist of Zillow

Although persistent house value drops to anything close to pre-pandemic levels are extremely unlikely, the frenzied speed of price increases observed earlier in the pandemic isn’t expected to recur.

-

Odeta Kushi, the deputy chief economist at the title business First American, said that annual house price rise will slow down but still be positive nationally. In other words, while monthly changes in home values may be negative, annual changes are not anticipated.

“The record-breaking annual house price appreciation nationwide in 2021 and early 2022 was due to a supply and demand imbalance. Pandemic-era dynamics only exacerbated this divide and further contributed to price growth.”

– Odeta Kushi, Deputy Chief at First American

There is still a structural and long-term scarcity of homes across the country, but in some places, demand is declining sharply and inventory is increasing more quickly to meet intermediate demand, which has moderated house price increases and will probably continue to slow over the coming year.

-

The National Association of Realtors Senior Economist and Director of Forecasting, Nadia Evangelou, predicts that home values will continue to decline in 2023. By the end of 2022, we anticipate that the increase in housing prices will slow to 5%. (In relation to costs at the end of 2021).

“While rising mortgage rates and home prices hurt affordability, many buyers are priced out of the market. Nearly 20% fewer households can afford to buy the median-priced home compared to last year.”

– Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors

Demand has decreased since there are fewer buyers in the market. Under normal circumstances, falling demand causes property prices to decline. But the demand for homes still exceeds the supply. Although inventory may have increased, it is not enough to cause a decline in home prices. Since the housing supply will be limited for the foreseeable future, we do not anticipate a decline in home prices.

The Bottom Line

The majority of experts appear to concur that this isn’t a “normal” property market or even a typical price adjustment. Prospective buyers are under pressure from inflation, a fragile global economy, rising mortgage rates, and a still-limited inventory of available homes for sale. It is still unclear how far they will retreat and how much that retreat will lower prices. Simple logic underlies this. Real estate is already seeing the effects of supply and demand, and this will likely continue for the years ahead.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!

Follow Hashtags: #Condominiums #INCOME #Residential #Seller

Joan Fitzpatrick

Joan Fitzpatrick