As the year 2025 approaches, many prospective homebuyers and sellers are eager to know what lies ahead for the housing market. Key factors such as mortgage rates and home prices often dictate market activity and influence real estate decisions. The good news is that experts are predicting a more favorable market landscape, particularly with mortgage rates set to decline and home prices stabilizing at a more moderate pace.

Whether you’re in the market to buy your first home, sell your current property, or simply curious about where the housing market is headed, understanding these two fundamental aspects can help guide your decisions. In this article, we’ll take a deep dive into the expert forecasts for mortgage rates and home prices in 2025, analyzing how these trends could impact the real estate market, your purchasing power, and selling opportunities.

Mortgage Rates in 2025: A Slight Decline on the Horizon

One of the most pressing concerns for anyone looking to purchase a home or refinance an existing mortgage is the direction of mortgage rates. In recent years, rates have been on an upward trajectory, pricing out many buyers and leading to increased affordability challenges. However, experts predict that mortgage rates will begin to ease slightly in 2025, offering some relief to potential homebuyers.

Although the decline in mortgage rates isn’t expected to be drastic or linear, the overall trend is anticipated to be downward. Economic data, including inflation rates and Federal Reserve policy decisions, will play a major role in determining how quickly and significantly rates fall. As the broader economy stabilizes and inflation moderates, mortgage rates are likely to follow suit, allowing prospective buyers to benefit from more affordable financing options.

The projected dip in rates could have a ripple effect throughout the housing market. Lower borrowing costs mean that potential homebuyers will experience reduced monthly mortgage payments, improving their purchasing power and affordability. For example, if mortgage rates fall by just one percentage point, it can lead to significant savings over the life of a 30-year loan, making homeownership more attainable for a larger pool of buyers.

According to Charlie Dougherty, Director and Senior Economist at Wells Fargo, lower financing costs are expected to pull affordability-crunched buyers off the sidelines and back into the market. This influx of buyers, coupled with more attractive financing options, will likely spur increased competition for available properties.

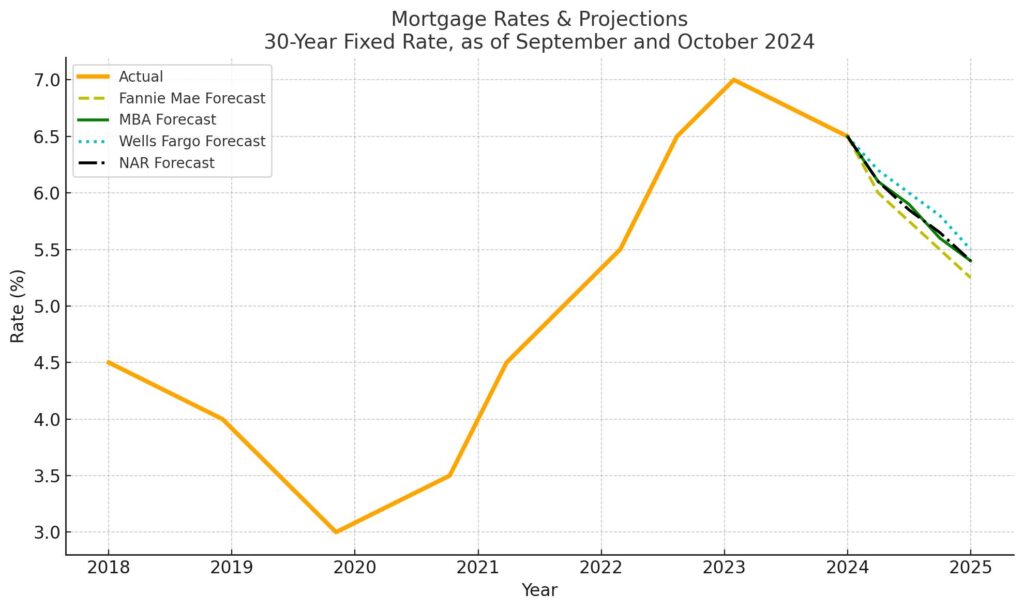

A graph showing mortgage rates and projections for the 30-year fixed rate as of September and October 2024. The graph includes actual historical data and projected trends from Fannie Mae, MBA, Wells Fargo, and NAR.

However, as more buyers re-enter the market, it’s important to note that inventory constraints could still pose challenges. The housing market has been grappling with a supply shortage for years, and while a reduction in mortgage rates may encourage more sellers to list their homes, the balance between supply and demand will need to stabilize to prevent significant price spikes. Prospective buyers should stay informed about local market conditions and work with real estate agents who can provide valuable insights into evolving trends in their area.

Home Prices: Modest Growth Ahead

While mortgage rates are set to come down in 2025, home prices are expected to continue rising, albeit at a slower and more sustainable pace compared to the rapid gains seen in previous years. Nationally, home prices are forecast to increase by approximately 2.5% in 2025, a much more manageable growth rate for both buyers and sellers.

In contrast to the double-digit price growth observed in some markets in recent years, this projected increase reflects a healthier housing market. The more moderate pace of price appreciation should help temper affordability concerns, making it easier for buyers to enter the market without facing the same level of financial strain that was common during the pandemic housing boom.

Several factors are contributing to this continued, albeit slower, price growth. As mortgage rates decline, more buyers are expected to return to the market, increasing demand for available homes. At the same time, many sellers who were previously “rate-locked” — hesitant to sell their homes due to high borrowing costs for their next property — may feel more confident about listing, leading to a gradual rise in inventory levels.

However, the housing market remains dynamic, and regional variations in price trends are expected to persist. While the national forecast suggests modest growth, local market conditions can vary significantly. Some regions may experience faster price appreciation, while others could see more stagnant or even declining prices. Lance Lambert, Co-Founder of ResiClub, notes that even if the average national home price forecast for 2025 holds true, regional housing markets could experience divergent trends, with some seeing mild home price declines while others continue to experience elevated price growth.

For buyers and sellers alike, this means that understanding local market dynamics will be critical to making informed real estate decisions. In areas where inventory remains tight and demand is strong, home prices could climb more quickly than the national average. Conversely, regions with more balanced supply-demand conditions may experience more gradual price increases, or even temporary price reductions.

One thing is clear: the rapid, unsustainable price hikes of the past few years are unlikely to return, providing a more stable environment for homebuyers and sellers in 2025.

Inventory and Market Competition: What to Expect

As mortgage rates ease and more buyers re-enter the market, inventory levels will play a crucial role in shaping housing market conditions in 2025. The years leading up to 2025 have been characterized by a persistent housing supply shortage, exacerbated by factors such as construction delays, labor shortages, and zoning restrictions in many markets.

Despite these challenges, there is optimism that inventory will increase as more sellers feel confident about listing their homes in a lower-rate environment. As previously mentioned, the phenomenon of rate-lock — where homeowners were hesitant to sell because they’d face higher borrowing costs on their next home — has been a major barrier to increasing housing supply. With mortgage rates set to come down, more homeowners may be motivated to sell, freeing up much-needed inventory for buyers.

However, while an increase in inventory is expected, it may not be enough to fully balance supply and demand, particularly in high-demand markets. Buyers should prepare for the possibility of heightened competition in these areas, especially if inventory remains below historical norms. Engaging with a knowledgeable real estate agent who understands the nuances of local supply and demand can help you navigate this competitive landscape and secure the best possible deal on a home.

It’s also important to note that new home construction may play a key role in alleviating supply shortages. If builders can ramp up production and deliver more new homes to the market, it could help relieve some of the upward pressure on prices and provide buyers with additional options. However, the pace of construction is likely to be influenced by a range of factors, including labor and material costs, zoning regulations, and economic conditions.

What Does This Mean for Buyers and Sellers?

For buyers, the 2025 housing market presents an opportunity to purchase a home in a more stable environment. With mortgage rates expected to decline and home price growth moderating, affordability is likely to improve, making homeownership a more realistic goal for many. Buyers should keep a close eye on mortgage rate trends, as securing a lower rate could significantly enhance their purchasing power.

Working with a local real estate expert is key to navigating the market effectively. As regional price trends can vary widely, understanding the specific conditions in your target market can help you make more informed decisions and avoid overpaying for a property.

For sellers, the outlook is also positive. While price growth will be more modest, rising home values mean that sellers can still expect to see appreciation in their property. The key to maximizing the sale price will be timing and understanding buyer demand in your area. Sellers should also be prepared for increased competition as more homes come onto the market in 2025. Partnering with a real estate agent who has a deep understanding of local market trends can help you position your home for success and attract motivated buyers.

Conclusion: 2025 Housing Market Holds Promise

As we look ahead to 2025, the housing market is poised for a period of stability and gradual growth. While mortgage rates are expected to ease, providing much-needed relief to buyers, home prices will continue to rise, albeit at a more moderate pace. These factors, coupled with an anticipated increase in inventory, suggest a more balanced and competitive market for both buyers and sellers.

Whether you’re planning to buy, sell, or simply keep an eye on market trends, staying informed about these key developments will be essential. With the right strategy and expert guidance, you can make the most of the opportunities that lie ahead in 2025.

If you have any questions or want to explore how these trends may impact your plans, be sure to connect with a local real estate agent who can provide personalized advice and help you navigate the evolving housing market landscape.

Follow Hashtags: #LocalSocialPro

Lauren Labossiere

Lauren Labossiere