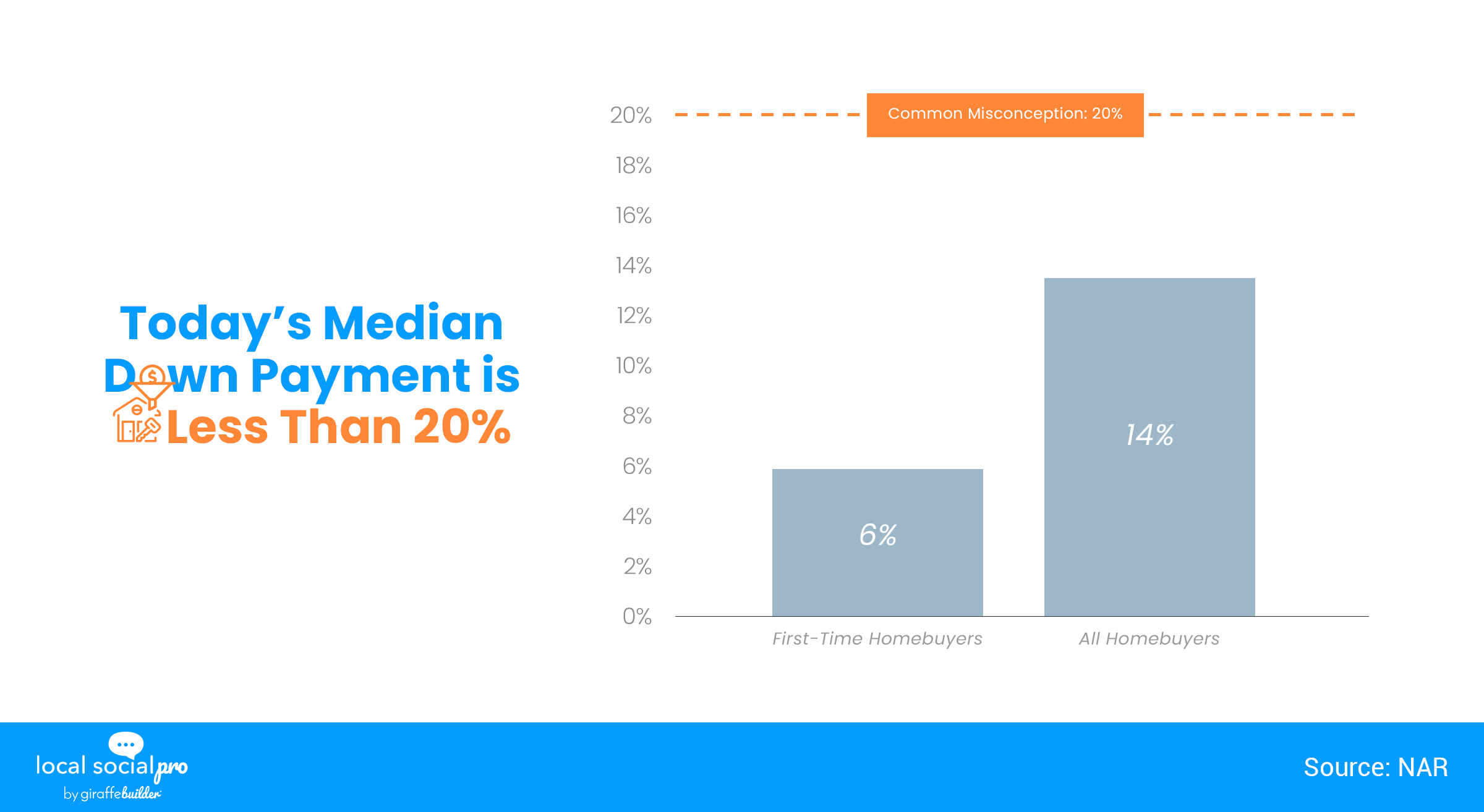

The biggest obstacle for potential home buyers can be obtaining the money for a down payment on a home. But how much of a deposit do you actually need? If the amount you need to save for that troubles you, it could be because you think you need to put 20% down. It might surprise you to learn that you don’t actually need to put 20% down on your house. In fact, according to Freddie Mac, the typical down payment for first-time homebuyers is only 6%. And you could even put down less. But how does the math work out in terms of your mortgage payments each month? Here are your options.

Add Primary Mortgage Insurance

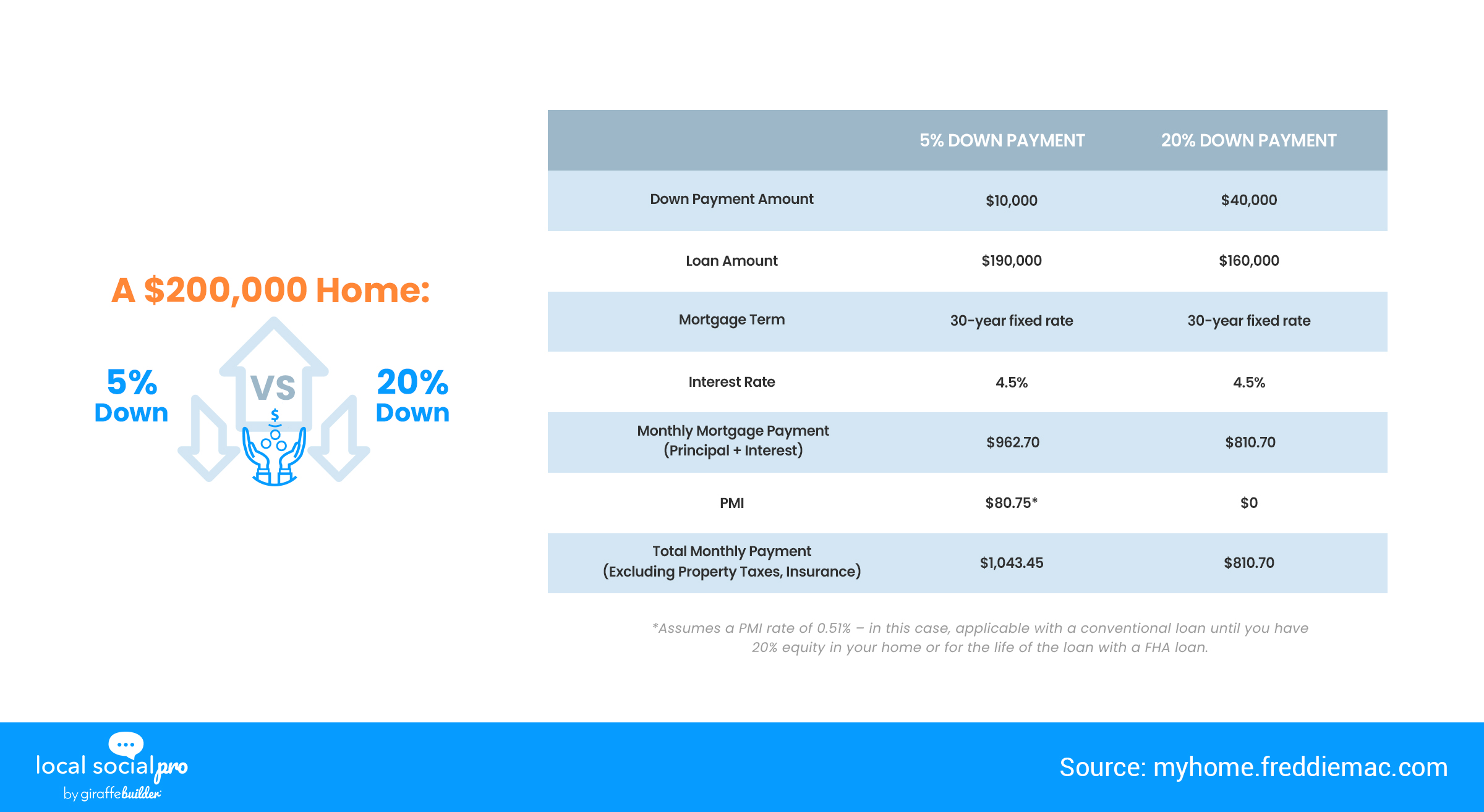

If you have a conventional loan and a down payment of less than 20%, your lender will require private mortgage insurance (PMI). This is an additional insurance policy that protects the lender if you can’t pay your mortgage. You will have to spend a little bit more each month because this will add to your monthly mortgage bill.

Depending on your credit score and loan-to-value ratio, PMI fees can change. You must pay PMI for the duration of some loan types, including FHA loans. On the other hand, for many other loans, you can ask your lender to remove your PMI once you’ve amassed 20% equity in your house. They could take that out of your regular payment.

Include Principal and Interest

Here is an illustration showing how different down payment amounts affect your monthly mortgage payment. This will show your loan’s total monthly expenses as well as PMI.

The amount of cash you have to borrow decreases as you make larger down payments. Your monthly payments will be lower the less money you borrow.

It’s not necessary to put 20% down unless your loan type or lender states otherwise. You might be closer than you think to achieving your dream of homeownership

The average down payment hasn’t exceeded 20% since 2005, according to NAR. In actuality, 14% down is the current average for all homebuyers.

Weigh the Advantages and Disadvantages

Consider these factors when weighing the benefits and drawbacks of various down payment options:

- Homebuyers who put at least 20% down on a home are exempt from PMI and will pay less interest overall.

- If putting 20% down would put you in a precarious financial situation without a safety net, it’s probably not in your best interest.

- A lower down payment can help you take advantage of the economy if mortgage rates are low when you are buying.

The Bottom Line

There are benefits to making a smaller down payment. It helps you to set aside more of your savings for closing costs, lender fees, and any renovations your new home needs. Likewise, to all other moving-related costs. If you don’t have enough money to cover the down payment and closing costs, you might be eligible for down payment assistance. So don’t rule out purchasing a home because you’re waiting to save 20% down.

What To Do:

Did you find this read interesting? Need expert and white-glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional specializing in this topic and more!

Follow Hashtags: #LocalSocialPro

Juan Chavez

Juan Chavez