This year, the US housing market is going through a pivotal time with opposing predictions for its future. The last few years have seen a significant expansion of the housing market, with home prices reaching all-time highs due to historically low mortgage rates and strong demand. On the other hand, worries about a housing market crash have begun to emerge, with certain analysts ringing concerns that the US housing market may be close to collapsing.

The housing market is finally slowing down after a record-breaking run that saw mortgage rates fall to historic lows and home prices soar to new highs. Through January 2023, home sales had been in decline for a continuous 12 months, and home values appeared to have peaked. The market has begun to demonstrate a year-over-year decline in home prices on a national level. The median home price between February 27 and March 26 was $361,000, which is 2% less than it was at the same time in 2022. According to Lawrence Yun, the National Association of Realtors’ chief economist, “Half the country is experiencing price declines.”

Although that may sound concerning, analysts and housing economists say that any correction is probably going to be modest. Price declines on the magnitude of those seen during the Great Recession are not anticipated by anyone. Numerous economists believe that the housing market will more likely correct itself following the double-digit percentage increases seen in home prices over the past few years than a crash because of the persistent inventory issue that is keeping prices high. As stated by Yun, “[H]ome prices will remain stable in the majority of the nation with only a slight change in the national median home price.”

Since a lot of borrowers have positive equity in their homes, other experts note that today’s homeowners are also in a much better position than those who were recovering from the 2008 financial crisis. It follows that there is little chance of a housing market crash.

“Home sales started strong in early 2022 but took a nosedive later in the year. On the plus side, generous amounts of home equity will protect many borrowers from experiencing the type of foreclosure activity seen during the Great Recession.” – Molly Boesel, Principal Economist at CoreLogic

Simply put, they think our inventory is insufficient. Though it is thought that some markets will experience a price decline, a repeat of a 30% price decline is extremely unlikely given the lack of supply.

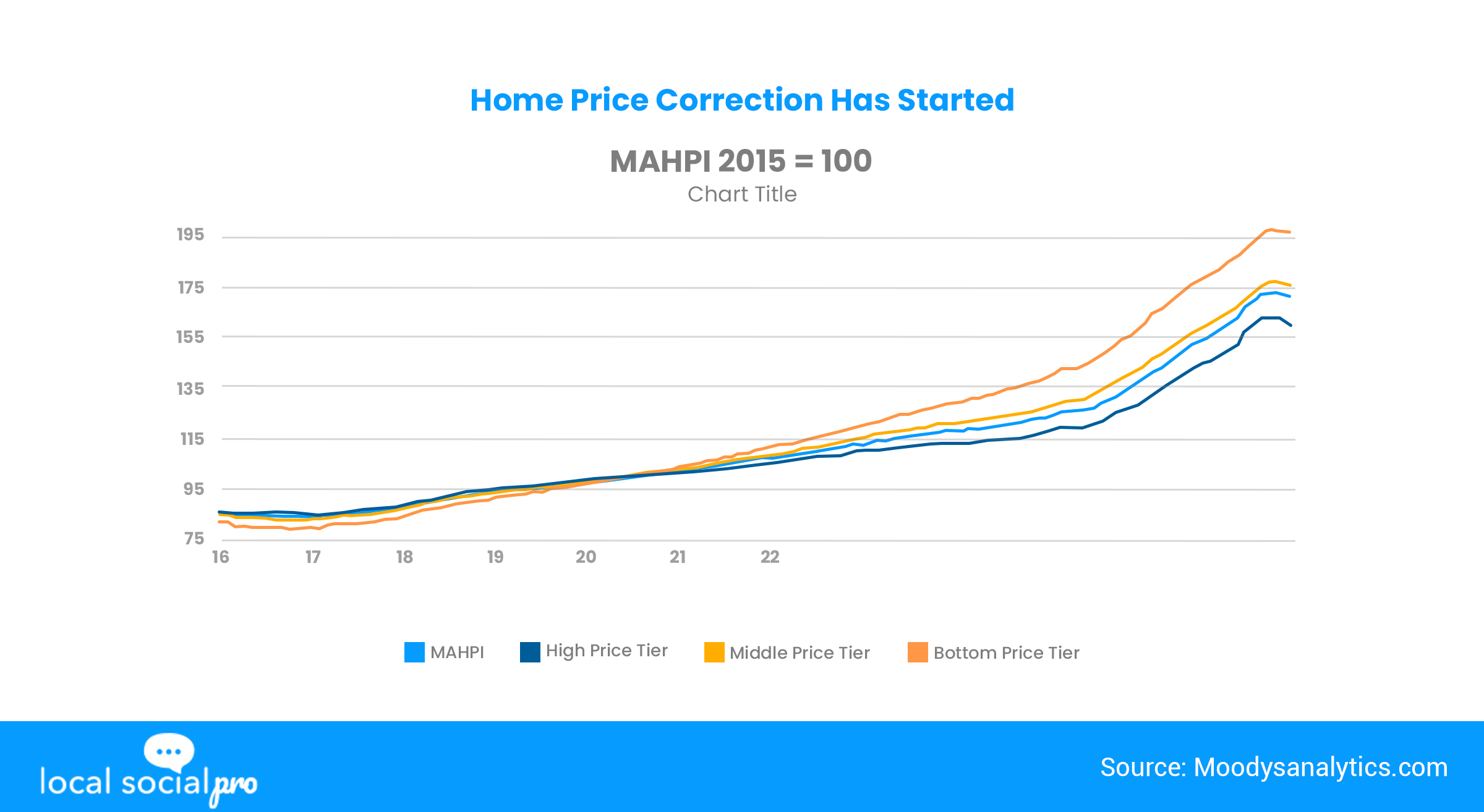

More than what is currently occurring, a housing market crash would typically result in a 20% to 30% drop in home prices and a drop in home sales. The national housing market was more inflated in Q2 2022 than it was in 2006, according to estimates from Moody’s Analytics. These valuation peaks cannot be maintained. By the beginning of 2025, prices are anticipated to have dropped 5 to 10% from their most recent peaks. It’s crucial to remember that a decline of 7.5% only qualifies as a correction and not a crash. There won’t be a housing bubble like there was during the Great Recession. The FHFA purchase-only HPI is anticipated to revert to late 2021 levels in early 2025. Only the gains made this year will be eliminated by declines. We anticipate prices to be nearly 30% higher than they had been at the start of 2020 by 2025, when the next low will be reached.

Given current demographics, there is still a significant housing shortage of 1.5 million units, which is estimated to be caused by expected household formations and up-to-date rental rates. Overall, given the increase in interest rates and the overpriced housing market, this decline was expected. It is not a sign of a housing market crash because correction is required for the market to reach sustainable levels. As long as there is a continued need for housing, the market is likely to recover and prices will likely increase once more.

The Bottom Line

With multiple opinions on the market’s future, the US housing market is going through a critical period in 2023. Some analysts worry about a crash in the housing market, while others predict an increasingly balanced market with single-digit yearly increases. Although there are changes in the market, most real estate experts don’t think that they will cause a crash or a recession. It is predicted that there are no indications that the housing market will crash again this year, despite the possibility of a decline in demand and a slight slowing of the pandemic-induced housing boom.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!

Follow Hashtags: #LocalSocialPro

Artis Adams & Ava Christian

Artis Adams & Ava Christian