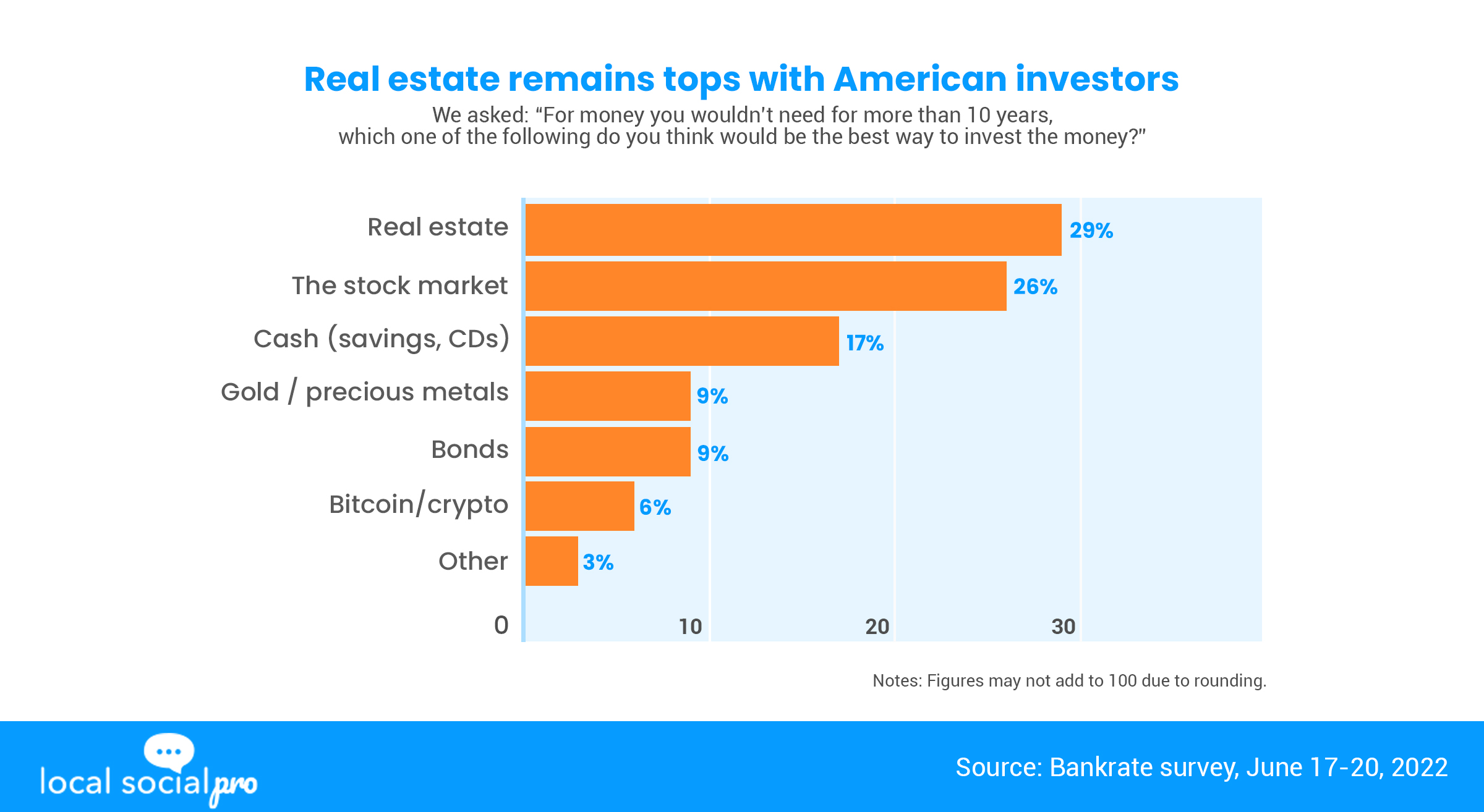

Real estate investing is generally a long-term endeavor, so anyone considering getting involved should approach it from that perspective. Before investing, it is wise to research potential outcomes and trends, as with all investment opportunities. According to a recent Bankrate survey, 29% of Americans said real estate was their top choice for investing money they won’t need for at least 10 years. Despite being steady, the real estate market is dynamic and constantly subject to change. Naturally, this fact might prompt the query, “What does the future of real estate look like?” The outlook is positive.

The Future of Real Estate

Real estate housing markets are anticipated to change as millennials, a new wave of homebuyers, enter the market. The Urban Land Institute study indicates that millennials are beginning to enter the real estate market with a focus on suburban areas. 80 % of homebuyers, according to the National Association of Home Builders, would be positively influenced by energy efficiency. The survey covered Energy Star appliances, insulation that was above code, and properly insulated windows. These features should be kept in mind by real estate investors who specialize in new construction and house flipping and should be incorporated as necessary. On the low end, Fed then increased interest rates at an unprecedented rate. Real estate has become less accessible as a result of the rate increases, and many home sellers have been lowering their prices. The average 30-year mortgage rate was just under 7 % in early 2023, which was a record high. However, real estate investing is a timeless activity, and everyone should view it this way. Even though interest rates are high right now, it might be best to start saving money for a down payment while awaiting a decrease in rates. The real estate housing market’s future holds several intriguing changes overall. Investors should monitor their respective markets to determine when to capitalize on emerging trends.

Depending on your investment strategy, real estate has a wide range of tax advantages, but purchasing real estate can result in some sizable tax benefits. Let’s go over them based on the type of investment:

Depending on your particular financial situation, you might be eligible for deducting any interest costs from your mortgage. Property taxes can be written off for up to $10,000 on an itemized tax return. If you’ve lived in the home for two years and two of the last five years, you can receive $250,000 in capital gains (or $500,000 if you’re married and filing jointly) tax-free when you sell your home.

In some cases, you might be able to write off any mortgage interest costs. You can also deduct property taxes from rental income to lower your taxable gains. As you continue to receive the cash flow, you could also deduct your interest expense and depreciation, further lowering your taxable income. Taxes are calculated based on the lower depreciated value of the investment property when it is later sold. However, you can postpone paying taxes on the gain if you transfer the revenue of a sale into a new residence and abide by the 1031 regulations.

As long as investors can continue to find profitable real estate deals, they can continue to defer paying taxes on gains by investing their proceeds into their subsequent deals and adhering to the 1031 exchange regulations.

REITs have a favorable tax profile in that you won’t pay taxes on capital gains until you sell your shares, which allows you to keep your shares for years on end without paying any taxes. Your heirs won’t have to pay taxes on your gains if you leave the shares to them. Because REITs do not pay corporate taxes, any money paid to you has only been subject to one round of taxation.

-

Online Real Estate Platform

Depending on the precise type of investment you make, the taxes resulting from these investments may change. While some investments may be debt or equity investments, some are technically REITs and will be treated as such (with no taxes at the corporate level). In general, any income from these, such as a cash distribution, will be subject to tax in the year of receipt, as opposed to capital gains, which will be subject to tax only when they are recognized.

The Bottom Line

Real estate investing offers a variety of opportunities for investors with different budgets. Real estate can be a lucrative investment, but buyers should make sure that the type of property they choose is one that they are willing and able to manage, including in terms of time commitments. Investors should concentrate on research, education, and mentoring if they want to adapt and innovate alongside industry giants. Although there is still much to learn about the real estate market’s future, investors can develop their professional judgment and take action when necessary by consistently trying out fresh ideas. Overall, investors have a lot to look forward to when it comes to the future of real estate.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!

Follow Hashtags: #LocalSocialPro

Artis Adams & Ava Christian

Artis Adams & Ava Christian