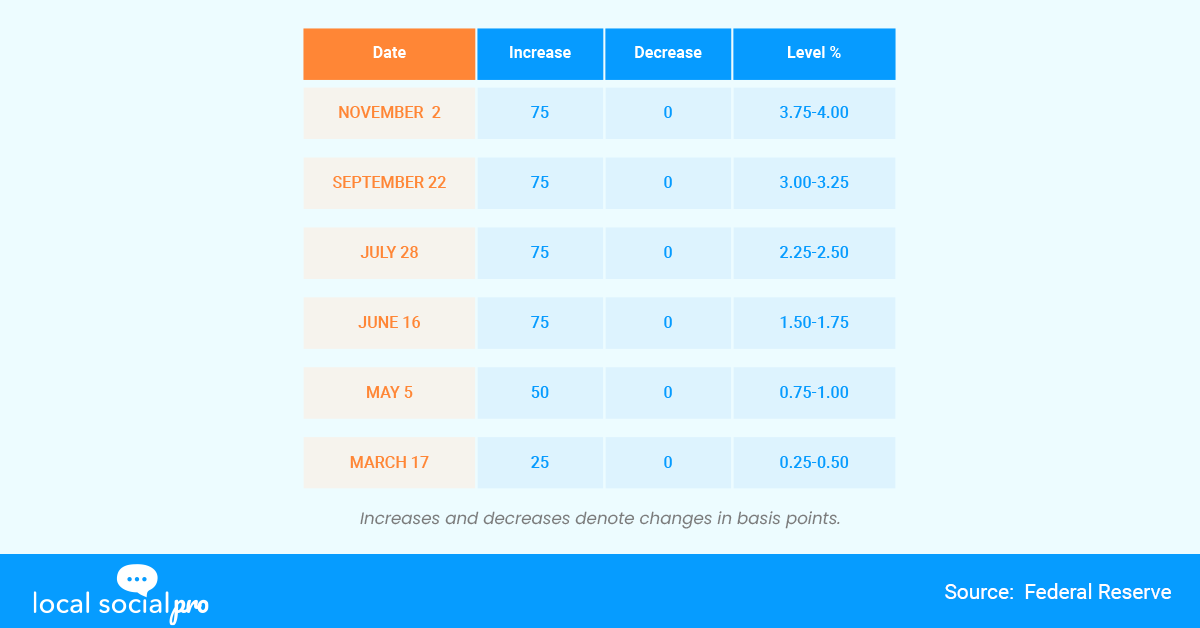

The Federal Reserve announced a fourth consecutive three-quarter point hike in interest rates, signaling a possible shift in how it will handle monetary policy to reduce inflation. Even as households of all income levels feel past rate increases, it was the Fed’s sixth rate hike of the year. The central bank boosted its narrow loan rates by 0.75 percentage points to 3.75%-4%, the highest since January 2008. Another hike is scheduled before the end of the year, and the central bank has promised to keep rates high until inflation returns to normal levels. The Fed’s most recent action increased its benchmark rate from 3.75% to 4%, the highest point in 14 years. Its continuous rate rises have already made borrowing for homes, cars, and other purchases more expensive for families and businesses. And additional raises are virtually certainly on the way.

How does it Affect the Monetary Sector?

Modifications in the federal funds rate have an impact on both domestic and international markets. Bond dealers, Wall Street bankers, and market analysts are all attempting to forecast the Fed’s next moves. This enhances the impact of interest rate hikes and central bank communications. Analysts may examine Fed speeches in the hopes of deriving any signals on the precise scale of the upcoming interest rate hike, allowing markets to begin pricing in any moves ahead of time. Changes in the Fed’s overnight rate also have an impact on the value of various financial instruments.

Which Consumers are Significantly Affected?

According to Scott Hoyt, an analyst with Moody’s Analytics, anyone borrowing money to make a significant purchase, such as a home, car, or large equipment, will take an impact.

“The new rate pretty dramatically increases your monthly payments and your cost… It also affects consumers who have a lot of credit card debt — that will hit right away.”

– Scott Hoyt, Moody’s Analytics analyst

Hoyt did observe, however, that family debt payments as a percentage of income remain relatively modest, notwithstanding recent increases. As a result, even as borrowing rates continuously rise, many households may not instantly feel a significantly larger debt load.

“I’m not sure interest rates are top of mind for most consumers right now… They seem more worried about groceries and what’s going on at the gas pump. Rates can be something tricky for consumers to wrap their minds around.”

– Scott Hoyt, Moody’s Analytics analyst

In regards to the effect on credit cards, when the economy is facing a significant slowdown or inflation is increasing rise, they may increase or drop this rate in order to boost or reduce the cost of borrowing. This will also have an impact on the prime rate, which refers to the interest rate that banks charge their core customers. This rate is also used by credit card companies to calculate your APR, which, according to Federal Reserve data, will average 16.65% in the second quarter of 2022, while certain cards may have interest rates of more than 20%. These actions will eventually have an effect on you as a consumer. As a result, when the Fed boosts this rate, you’re likely to notice a few modifications in credit-card terms.

The Bottom Line:

Don’t be caught off guard by the Fed’s initiatives. Knowing when it may raise or lower interest rates can help you make more educated decisions about your own finances and come out ahead even if rates remain unchanged. It’s better to keep in touch with your local expert and figure out the best way to navigate through this ever-changing market.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!

Follow Hashtags: #Condominiums #INCOME #Residential #Seller

Joan Fitzpatrick

Joan Fitzpatrick