We’re nearing the end of 2022 and entering a new year. That makes now the ideal time to forecast real estate factors for 2023. With mortgage rates continuing to rise, home sales – and, in some regions, home prices – slowing, and increased market uncertainty, the majority of homeowners, prospective sellers and buyers are concerned about the future. Several industry experts shared their predictions and projections for mortgage rates, property prices, buyer competition, housing supply, total sales, and home affordability in 2023. We’ve gathered some of their assessments and forecasts.

Will mortgage rates rise further?

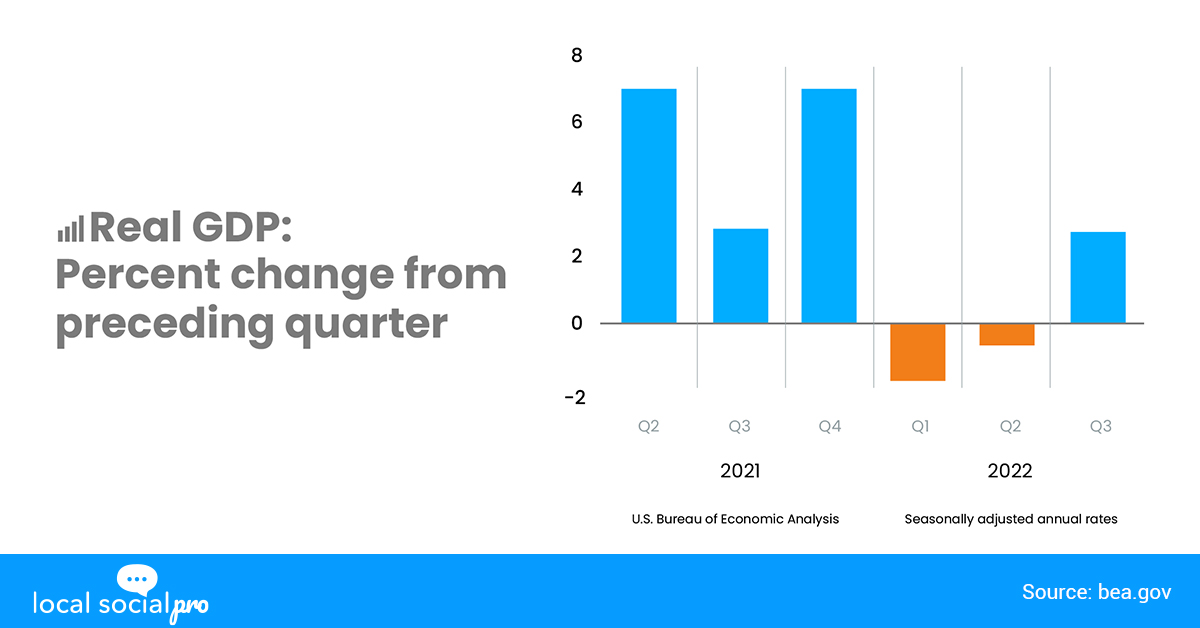

The third-quarter GDP data showed that the US economy grew at a rate of 2.6%, breaking the previous two quarters’ negative GDP streak. Following the release of the GDP report, the bond market rallied, transferring yields lower, which confused some people. Historically, when economic data improves, the 10-year yield falls, and profits rise along with mortgage rates. Similarly, as economic data weakens, so do 10-year yields and mortgage rates. Even though we had softer economic data earlier in the year, mortgage rates and bond yields have risen all year.

However, after more than doubling this year, mortgage rates are expected to fall in 2023, based on an updated forecast from the Mortgage Bankers Association. MBA economists also predicted that the Country would enter a recession in the first half of next year, owing to tighter economic circumstances, reduced business investment, and slower global growth. According to the forecast, this will raise the unemployment rate from 3.5% to 5.5% by the end of next year. According to MBA, mortgage origination volume is expected to drop to $2.05 trillion in 2023 from $2.26 trillion in 2022. Purchase mortgages are expected to fall by 3% next year, whereas refinance volume is expected to fall by 24%. The slowing of housing activity and rising mortgage rates will slow home price growth. According to the forecast, national home prices will be roughly flat in 2023 and 2024.

“This will allow household incomes some much-needed time to catch up to elevated property values”

– Joel Kan, Vice president, Deputy Chief Economist at MBA.

Over the next few years, first-time homebuyers will contribute to a significant portion of housing demand. However, because more homeowners are putting down roots and are hesitant to give up their ultra-low mortgage rates, there are fewer starter homes available. And, with a low inventory of available homes on the market and slowing new construction activity, housing supply is expected to remain limited. However, the mortgage industry will be affected as a result of this slowdown.

“The housing market will be tepid in 2023, with only lukewarm demand and a limited amount of inventory available for sale… Mortgage rates could pull back meaningfully next year if inflation pressures ease.”

– Greg McBride, Chief Financial Analyst for Bankrate

The Bottom Line:

The vision is that as the housing market’s supply and demand normalize, interest rates will begin to fall. Until this occurs, those who merely cannot afford the expense of borrowing funds will have to sit tight. Those on the sidelines hoping for a rate drop may have to accept that the lower-rate financing windows open in 2020 and 2021 have ended. At the start of the year, it appeared unlikely that mortgage rates could very well rise above 6%. The question now is, how far will they go? Much of the answer depends on how aggressively the Federal Reserve raises interest rates.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!

Follow Hashtags: #Condominiums #INCOME #Residential #Seller

Joan Fitzpatrick

Joan Fitzpatrick