Applications for government-backed purchase mortgages were up 4 percent week over week, accounting for nearly 1 in 4 loan requests from homebuyers, according to the Mortgage Bankers Association.

Mortgage rates are on the rise again, but a surge in demand for FHA, VA, and USDA purchase loans could be a sign that first-time homebuyers are becoming more willing to test the waters.

A weekly survey by the Mortgage Bankers Association shows demand for purchase loans fell last week by a seasonally adjusted 1 percent when compared to the week before, and was down 21 percent from a year ago. Applications to refinance were down 2 percent week over week and 21 percent from a year ago.

But a closer look at the numbers shows that even though demand for conventional purchase mortgages was down, applications for government-backed FHA, VA, and USDA purchase mortgages posted significant gains. Together, those three types of government loans accounted for close to one in four purchase loan requests.

The MBA survey showed applications for FHA-backed purchase loans favored by first-time homebuyers rose by a seasonally adjusted 4.7 percent week over week and accounted for 11.4 percent of purchase loan requests.

Demand for VA-backed purchase loans was up a seasonally adjusted 3.7 percent over the same period and accounted for 12.1 percent of purchase loan applications. While USDA purchase loan applications rose by a seasonally adjusted 8.5 percent from the week before, they accounted for less than 1 percent of all purchase loan applications.

“Mortgage applications continued to remain at a 22-year low, held down by significantly reduced refinancing demand and weak home purchase activity,” MBA forecaster Joel Kan said, in a statement. “Last week’s purchase results varied, with conventional applications declining 2 percent and government applications increasing 4 percent, which is potentially a sign of more first-time homebuyer activity.”

Although rates on all types of loans increased last week, the “spread” between conforming fixed-rate loans and adjustable-rate mortgages narrowed to 84 basis points from over 100 basis points the week before, Kan noted.

“This movement made fixed rate loans relatively more attractive than ARMs, thereby reducing the ARM share further from highs seen earlier this year,” Kan said.

After factoring in seasonal factors, demand for ARM loans was down 7.5 percent last week compared to the week before, and 30 percent from a month ago. ARM loan requests accounted for just 6.5 percent of all loan applications, the survey found.

Mortgage rates rebound

The Optimal Blue Mortgage Market Indices show rates for 30-year fixed-rate loans have been on the rise in August, but have a ways to go before breaching the 2022 high of 6.06 percent registered June 14.

The MBA reported average rates for the following types of loans for the week ending Aug. 19:

- For 30-year fixed-rate conforming mortgages (loan balances of $647,200 or less), rates averaged 5.65 percent, up from 5.45 percent the week before. With points increasing to 0.68 from 0.57 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans, the effective rate also increased.

- Rates for 30-year fixed-rate jumbo mortgages (loan balances greater than $647,200) averaged 5.28 percent, up from 5.14 percent the week before. With points increasing to 0.58 from 0.33 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 30-year fixed-rate FHA mortgages, rates averaged 5.43 percent, up from 5.38 percent the week before. With points increasing to 1.10 from 1.01 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- Rates for 15-year fixed-rate mortgages, popular with homebuyers who are refinancing, averaged 5.01 percent, up from 4.87 percent the week before. With points increasing to 0.84 from 0.64 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 5/1 adjustable-rate mortgages (ARMs), rates averaged 4.81 percent, up from 4.43 percent the week before. With points increasing to 0.74 from 0.43 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

Mortgage rates expected to ease

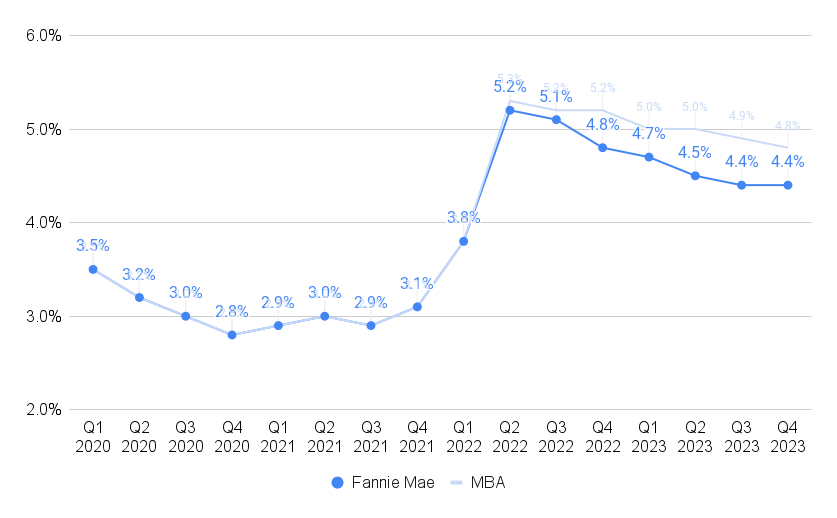

Source: Fannie Mae Housing Forecast, August 2022

In a forecast issued this week, Fannie Mae economists said they think mortgage rates have peaked and will trend downward into next year. In a July forecast, economists at the Mortgage Bankers Association predicted a similar, but the less pronounced pullback in mortgage rates.

Although Fannie Mae economists say there’s a risk that the Federal Reserve will continue to be aggressive in raising short-term interest rates if inflation and job growth remain strong, they anticipate less pressure on long-term interest rates including mortgages. That’s thanks in part to expectations that a “modest recession” is looming next year and that the labor market will soften as the effects of tighter monetary policy take hold.

Follow Hashtags: #LaTonyaBlair #RealEstate

LaTonya Blair

LaTonya Blair