Concerns of a housing bubble emerged due to the increase in demand and prices since the coronavirus outbreak. Many individuals have begun comparing the current housing boom to the mid-2000s. Home prices are at all-time highs, corporate spending is surging, builders are releasing many products to market, and housing inventory is shockingly low. It’s understandable that so many people would wonder whether the housing market is in a bubble.

According to most major real estate companies including data giants, CoreLogic and Fannie Mae, home prices will increase even more over the upcoming year. After correlating the nation’s home prices to underlying economic statistics, researchers at the Dallas Fed came to the conclusion that there are indications of a developing housing bubble. However, despite all the fears and forecasts, neither a housing bubble nor a crisis is imminent.

“Based on present evidence, there is no expectation that fallout from a housing correction would be comparable to the 2007–09 global financial crisis in terms of magnitude or macroeconomic gravity.” – The Dallas Fed researchers.

To begin with, homes are in much better condition today. Here are 3 valid points why a crash similar to the one that occurred in the 2000s won’t be possible: Strong Housing Demand, Limited Existing Supply, and Substantial Financing.

1. Strong Housing Demand

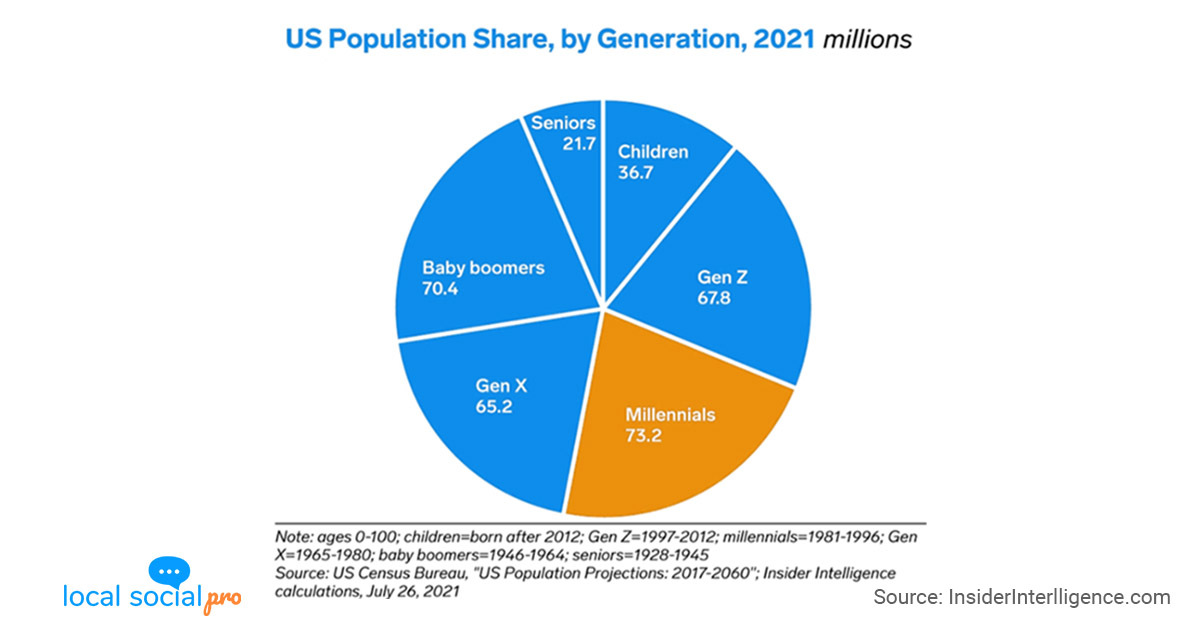

National real estate organizations predicted that the home market would encounter a dip when the pandemic hit. But it never occurred. Instead, the housing market was thriving, as first-time millennial homebuyers were lured in by historically low mortgage rates. The largest generational demographic in American history is the millennials. These individuals are in the age cohort where people often purchase a home and are substantially larger than boomers or Gen X. The peak home-buying years for Millennials are between 2022 and 2024. It is evident that there are many first-time homebuyers and younger millennials who have been frustrated with the present property market and are ready to purchase a home if they come across a good deal. Due to the desire to own a property, buying a home today is a strong, wise financial choice. Thus, the current demand is certainly real.

2. Limited Existing Supply

– There is a lack of supply due to the following reasons: significant housing shortage, difficulties with construction, and lack of home relocation.

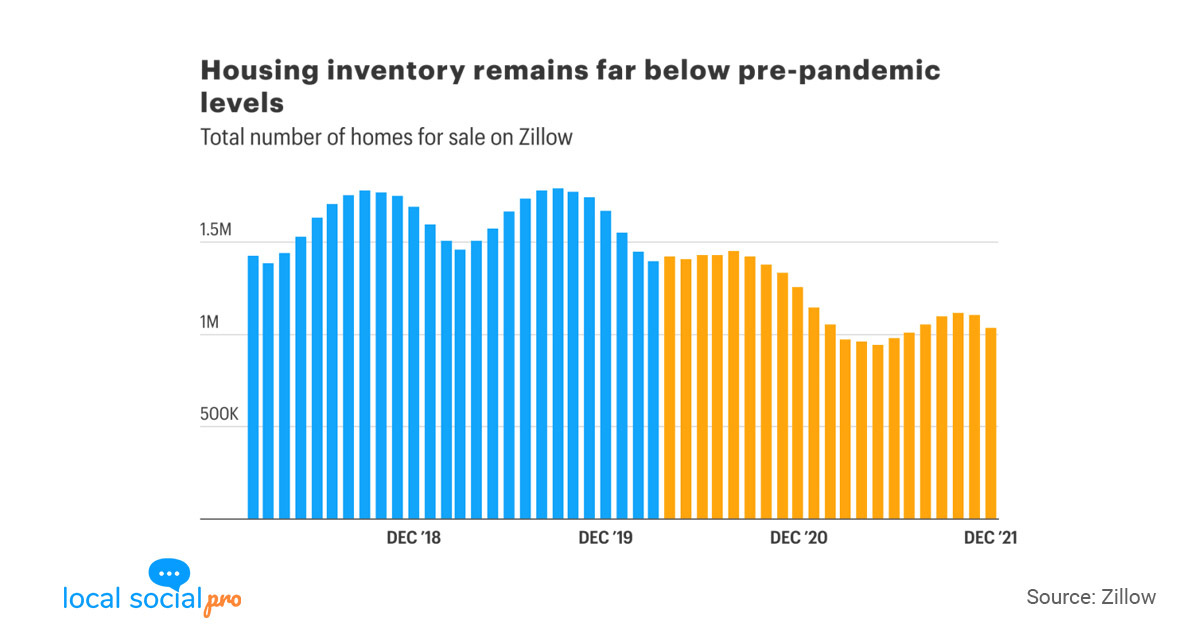

Demand is fueled by a number of factors besides the volume of people looking to buy homes. For other reasons, the housing market has a limited quantity of properties for sale. Despite an increase in new housing starts, it is predicted that the supply of new homes would remain far below the demand. The National Association of Realtors (NAR) estimates that the United States underbuilt 5.5 million homes during the past 20 years. Even taking into account the excessive construction that was taking place before the financial crisis of 2008, that is. The number of houses for sale was 43% lower than it was before the pandemic. To put it bluntly, prospective homeowners shouldn’t have high hopes after the most recent assessment of housing inventory levels. Even though the market for new homes is booming, there is not enough housing for all the residents, and the shortage is only getting worse.

Both the current labor shortage and the supply-chain problems following COVID-19 have had an impact on the capacity to construct new homes. Homebuilders may experience a decrease in production as a result of supply shortages, such as rising lumber and other material prices. Builders have found it challenging to preserve their personal profit margins while bringing new housing stock online that the nation sorely needs.

Typically, first-time homebuyers choose to expand into more valuable places as their families expand by starting off by buying affordable homes. Retirees frequently downsize as they become older. If this consistent movement of homes is preserved, the housing market can remain stable. However, many people simply don’t want to participate in the competitive housing market, where they will inevitably have to engage in bidding wars and compromise for homes that might not meet all of their desirable criteria.

The effect of mortgage forbearances and the protracted eviction ban have likely also reduced the usual turnover in the housing market. Although it may have had less of an impact than we had hoped, approximately 11 million people are still living in their rental houses, and over 2.2 million borrowers are still enrolled in mortgage forbearance programs. This reduces the very essential and typical volatility of the housing market once more. Lawrence Yun, chief economist of the National Association of REALTORS®stated:

“This is not a bubble. It is simply lack of supply.”

3. Substantial Financing

It’s anticipated that the Federal Reserve will raise rates due to concerns about inflation. Consequently, mortgage rates are already rising. It’s feasible that the affordability crisis brought on by rising mortgage rates will be beneficial. Experts say that higher mortgage rates may reduce market momentum and allow inventory to climb slightly. If that happens, it might cut down the growth of home price appreciation and lessen the chance that the hot housing market will eventually overheat or, worse yet, experience a housing bubble.

Data from First American reveals that consumer purchasing power has increased by more than twice since 2006 and that it not only stays close to record levels. According to census data, nominal median household income has climbed by almost 40% during that time, which is why they claim that today’s buyers are in far better financial shape.

We’ve learned from the previous housing bubble that reckless credit practices in the early 2000s were a major contributor to it. This is another reason that supports the idea that we won’t be seeing one anytime soon. Homeowners have restored their real net worth to levels seen before the recession. Despite the fact that the pandemic rocked the economy for a loop, 93% of the jobs that were lost have already been recovered, and the unemployment level is currently at 3.6%. Additionally, lending criteria have become stiffer, and housing values have recovered to record highs.

“It’s no secret the housing market played a central role in the Great Recession, but this market is just fundamentally different in so many ways.” – Odeta Kushi, the deputy chief economist at First American

The Bottom-Line:

Ultimately, historically low mortgage rates and a surge in first-time millennial homebuyers gave the current housing boom a boost despite the economic crisis. A combination of low-cost financing, exploitative lending practices, and leveraged buyouts resulted in many borrowers engaging in unaffordable mortgages, which sparked the housing bubble that precipitated the 2008 financial crisis. Hence, this time around, lending requirements are stricter, household equity is close to a three-decade high, and the household debt-to-income ratio is at a four-decade low. Home prices have dramatically increased across the country as a result of the scarcity of housing supply in the country. Even though this has made housing less affordable, it has also raised the worth of the wealth that homeowners possess in their homes.

Homeownership will continue to be viewed favorably as an economic indicator in a time of relatively high inflation. Buyers are just returning to normal, pre-pandemic levels, notwithstanding any concerns they may have about the changing market. The mid-2000s era housing bubble and crash are therefore improbable — at least for the foreseeable future.

Follow Hashtags: #LaTonyaBlair #RealEstate

LaTonya Blair

LaTonya Blair